felishagagai53

About felishagagai53

Revolutionizing Access: The Brand new Period of Personal Loans For Bad Credit

In recent years, the panorama of personal loans for people with dangerous credit score has undergone a significant transformation, pushed by technological developments and a rising understanding of financial inclusivity. If you adored this article and you would like to get more info pertaining to personal loans for bad credit under 500 kindly visit our own webpage. Traditionally, individuals with poor credit score histories confronted numerous limitations when searching for personal loans, usually being met with excessive-curiosity charges or outright rejections. However, an array of progressive options and merchandise have emerged, making it simpler for these with bad credit to access the funds they need. This article explores these developments, highlighting how they are reshaping the personal loan market for individuals with much less-than-perfect credit scores.

The Rise of Fintech Options

Some of the notable advancements in personal loans for bad credit comes from the rise of financial technology (fintech) corporations. In contrast to conventional banks, fintech firms leverage technology to streamline the lending process, often utilizing various information to assess creditworthiness. This shift allows them to offer loans to individuals who might have been ignored by standard lenders.

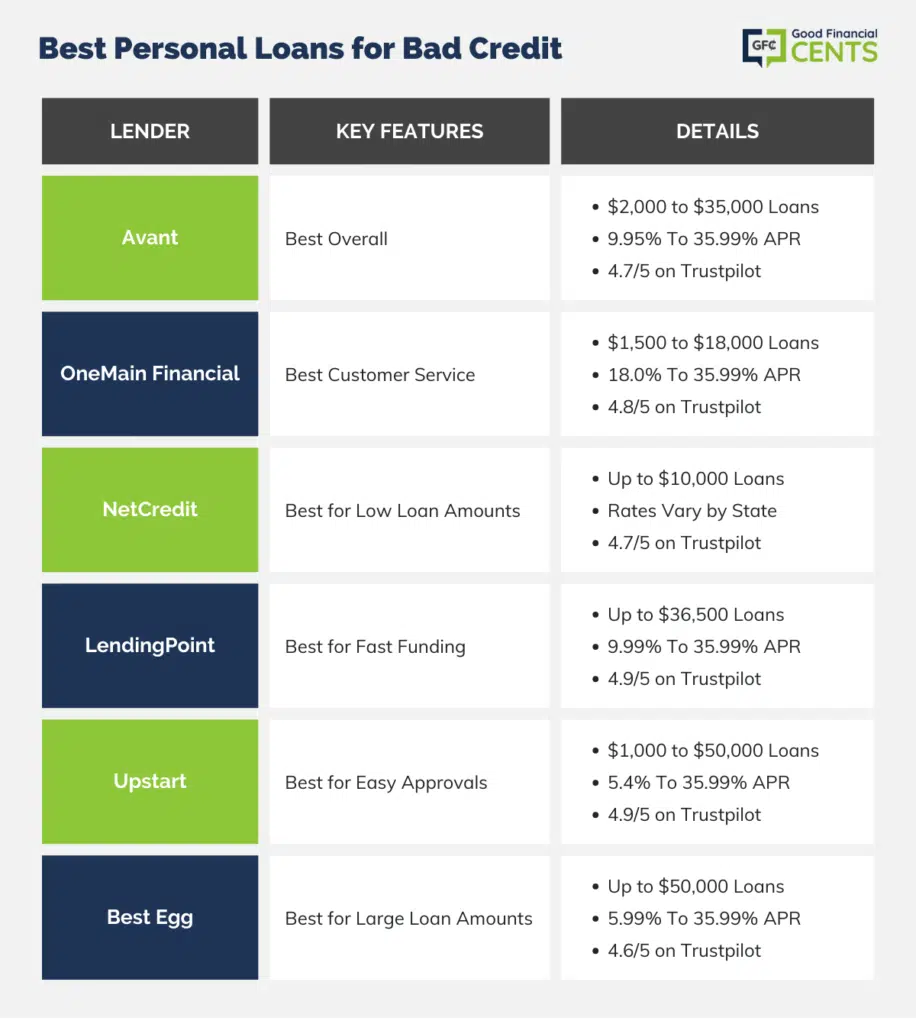

Fintech companies utilize a variety of information factors beyond simply credit scores, comparable to earnings, employment historical past, and even social media exercise, to evaluate a borrower’s ability to repay a loan. This holistic strategy not solely broadens entry to credit score but in addition gives a more correct picture of an individual’s monetary state of affairs. As an example, corporations like Upstart and Avant have gained popularity by offering personal loans to these with dangerous credit, using machine learning algorithms to assess risk extra successfully.

Peer-to-Peer Lending Platforms

Another important growth within the personal loan sector is the emergence of peer-to-peer (P2P) lending platforms. These platforms connect borrowers instantly with individual investors, bypassing traditional financial establishments. P2P lending has democratized access to personal loans, allowing individuals with bad credit to safe funding at aggressive charges.

Platforms like LendingClub and Prosper have made it simpler for borrowers to obtain loans by presenting their tales and financial needs to potential investors. This model not only fosters a way of group but also permits investors to make informed decisions based mostly on the borrower’s circumstances. As a result, borrowers with dangerous credit can usually find more favorable terms than they might with traditional lenders.

Specialized Lenders

In response to the demand for personal loans for bad credit, specialised lenders have emerged, focusing exclusively on this area of interest market. These lenders understand the unique challenges confronted by people with poor credit score and are keen to supply merchandise tailored to their wants. For example, companies like OneMain Monetary and BadCreditLoans.com cater specifically to borrowers with unhealthy credit score, offering choices that traditional banks could not provide.

These specialised lenders typically have extra versatile eligibility standards and are keen to work with borrowers to create manageable repayment plans. Additionally, lots of them present instructional sources to help borrowers improve their credit scores and financial literacy, fostering lengthy-term financial health.

Improved Transparency and Regulation

As the personal loan market for dangerous credit score evolves, there has been a push for better transparency and regulation. Prior to now, borrowers with dangerous credit often faced hidden charges and predatory lending practices, which exacerbated their financial struggles. Nonetheless, current regulatory modifications have aimed to protect shoppers and guarantee fair lending practices.

Organizations like the buyer Financial Protection Bureau (CFPB) have carried out guidelines that require lenders to disclose all terms and circumstances upfront, making it simpler for borrowers to understand the true price of a loan. This elevated transparency has empowered borrowers to make knowledgeable decisions, reducing the chance of falling into debt traps.

Versatile Loan Choices

Modern personal loan merchandise have also become more flexible, catering to the various wants of borrowers with unhealthy credit score. Many lenders now offer secured personal loans, where borrowers can use collateral (resembling a automobile or savings account) to secure a loan. This feature will be significantly interesting for these with bad credit, as it typically ends in decrease interest rates and higher borrowing limits.

Moreover, some lenders provide personal loans with flexible repayment terms, permitting borrowers to decide on a schedule that aligns with their monetary situation. This flexibility can alleviate the burden of month-to-month payments, making it simpler for people to manage their loans with out additional damaging their credit score.

Financial Schooling and Help

Recognizing that many people with dangerous credit score could lack monetary literacy, many lenders at the moment are specializing in providing instructional sources and support. This contains providing instruments and assets to assist borrowers higher understand credit scores, budgeting, and debt management. By empowering borrowers with data, lenders should not only helping them secure loans but also equipping them with the talents wanted for lengthy-time period monetary success.

Some platforms even provide customized monetary coaching, serving to borrowers develop methods to improve their credit score scores over time. This holistic strategy to lending fosters a sense of duty and encourages borrowers to take control of their monetary futures.

The Role of Credit score Unions

Credit unions have additionally performed a pivotal function in advancing access to personal loans for bad credit. These member-owned establishments usually have more lenient lending criteria compared to conventional banks and are known for his or her dedication to serving their communities. Many credit unions offer personal loans particularly designed for people with dangerous credit score, typically at lower interest rates and with more favorable terms.

Furthermore, credit unions sometimes prioritize member training and financial wellness, offering sources and assist to assist borrowers improve their credit score scores and general financial well being. This group-centered approach has made credit score unions a useful resource for these looking for personal loans with dangerous credit score.

Conclusion

The panorama of personal loans for bad credit has seen exceptional advancements in recent times, driven by innovation, inclusivity, and a commitment to shopper safety. From fintech solutions and peer-to-peer lending platforms to specialized lenders and improved regulatory oversight, borrowers with unhealthy credit score now have access to a wider vary of options than ever earlier than. As the market continues to evolve, it’s crucial for people to stay informed about their selections and seek out assets that can assist them navigate their monetary journeys. With the suitable assist and instruments, those with dangerous credit score can overcome boundaries and achieve their monetary goals.

No listing found.